Great Points

A weekly blog.

What Was Revealed In The September Job Report?

Last month’s government shutdown delayed the publication of the monthly September jobs report.

What Is Causing the Spike in Consumer Delinquency Rates?

For the first time since the COVID-19 pandemic, consumer delinquency rates are at an alarmingly high rate.

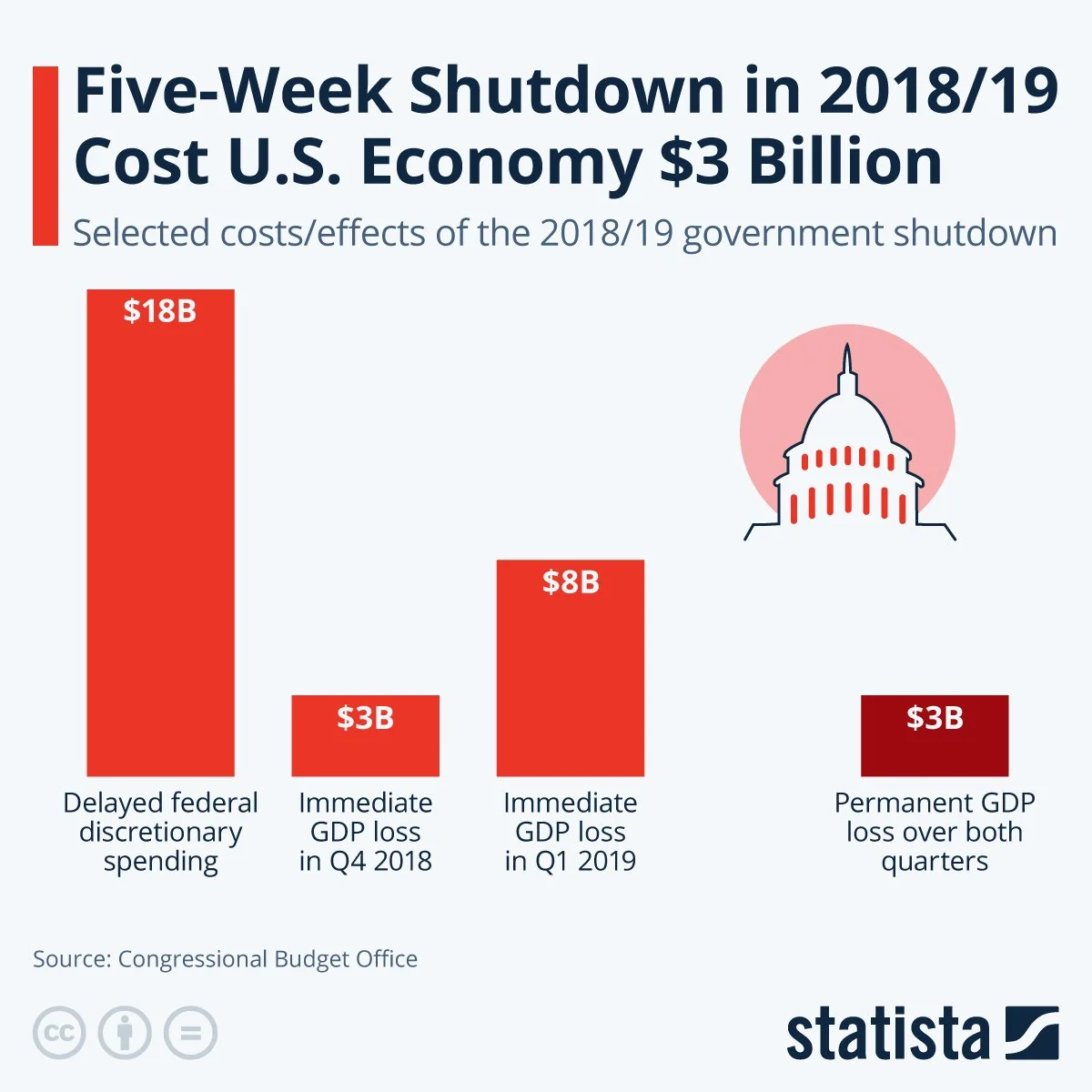

What Are the Economic Effects of a Government Shutdown?

The government shutdown, which began Oct. 1, poses a serious threat to the U.S. economy, with analysts predicting a loss of $3 billion, according to MSN.

How Are Personal Consumption Expenditures Measured?

The Personal Consumption Expenditures Price Index (PCEPI) measures goods and services spending by the U.S. consumer.

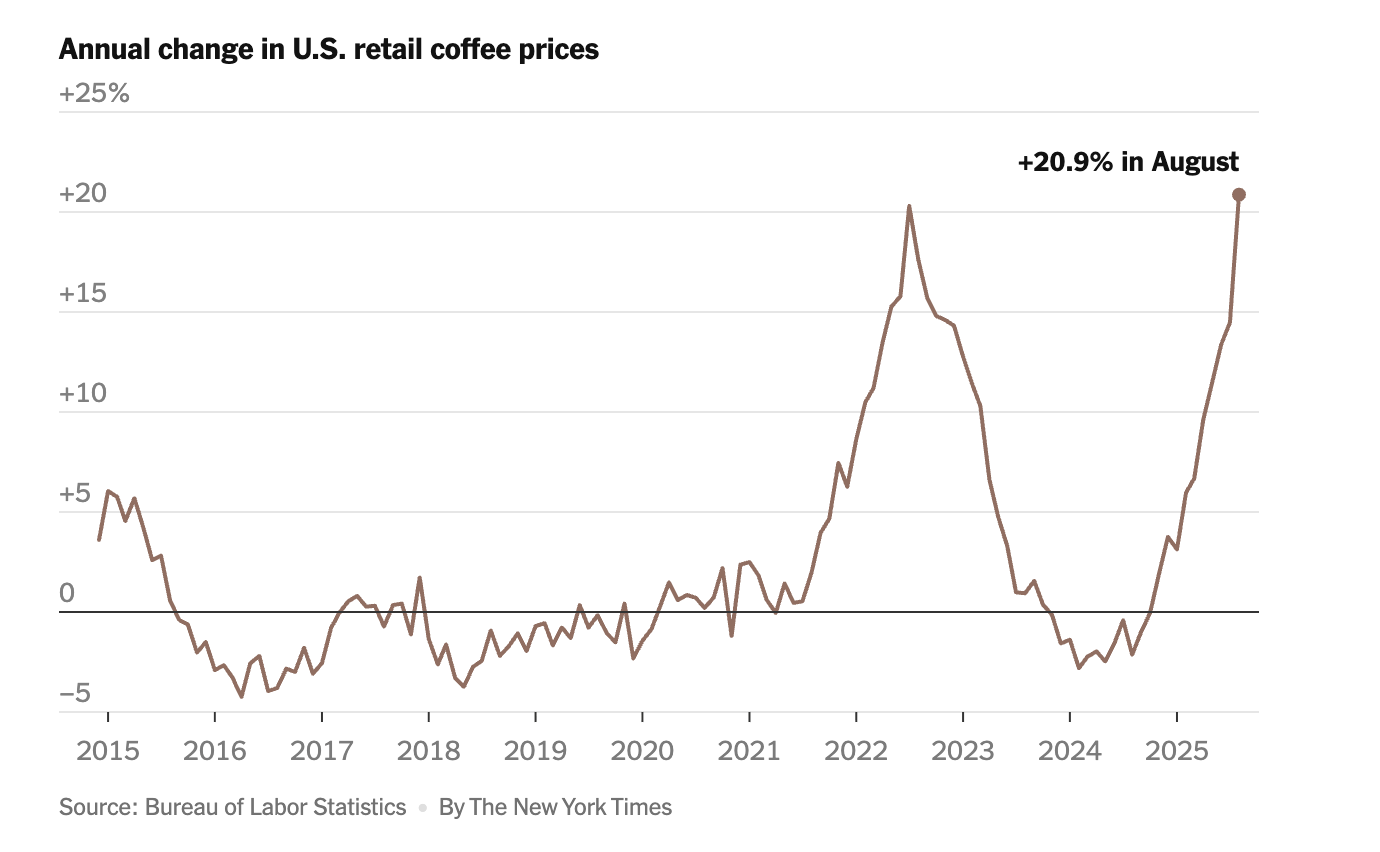

Inflation: Why Your Morning “Cup of Joe” Is Pricier

U.S. inflation continues to creep up. The CPI, released Sept. 11, indicated a 2.9% increase compared to this same time last year, according to the Bureau of Labor Statistics.

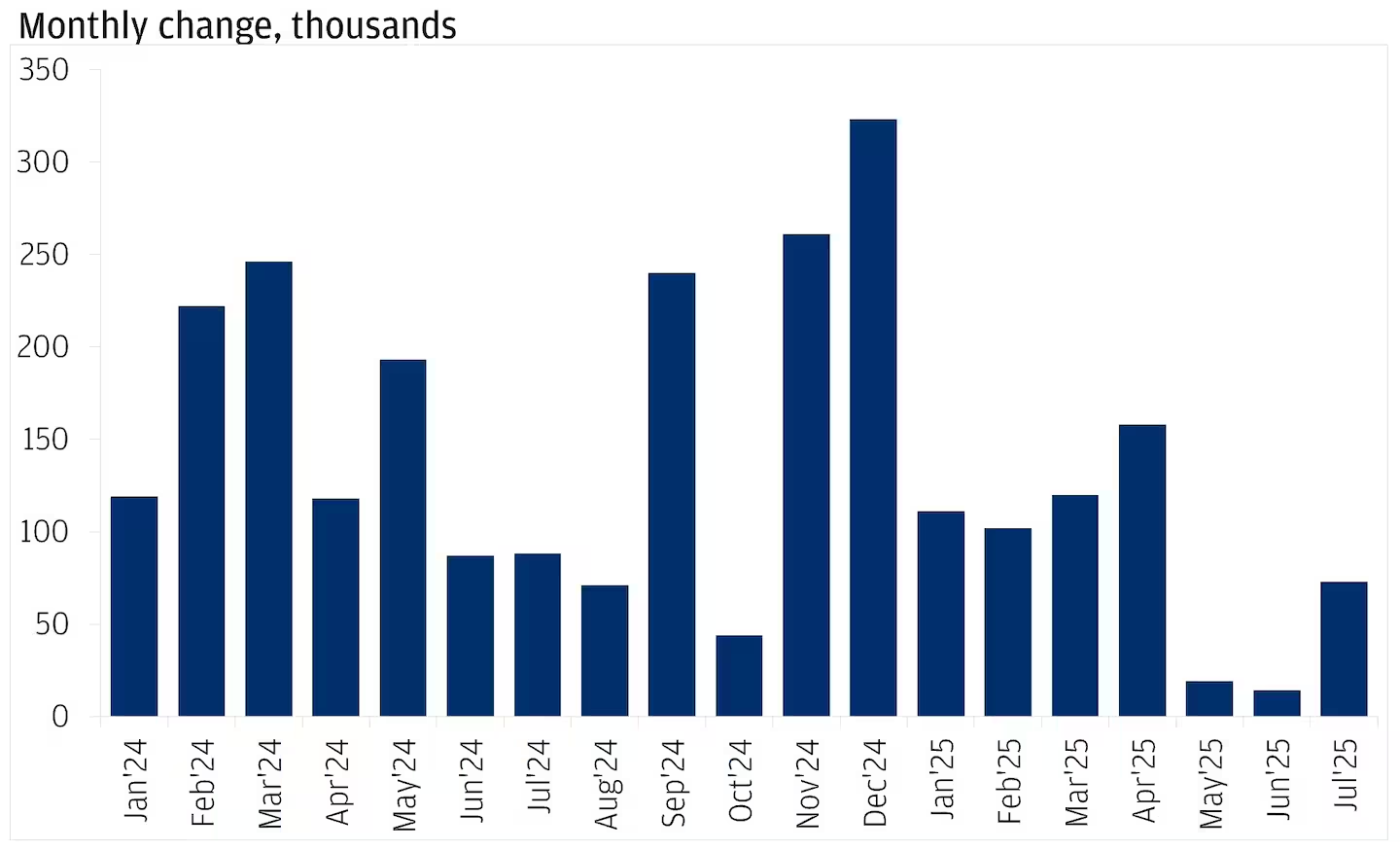

U.S. Employment Report Shows Slow Growth in August

The U.S. economy added just 22,000 jobs last month, a dramatic slowdown from 79,000 in July.

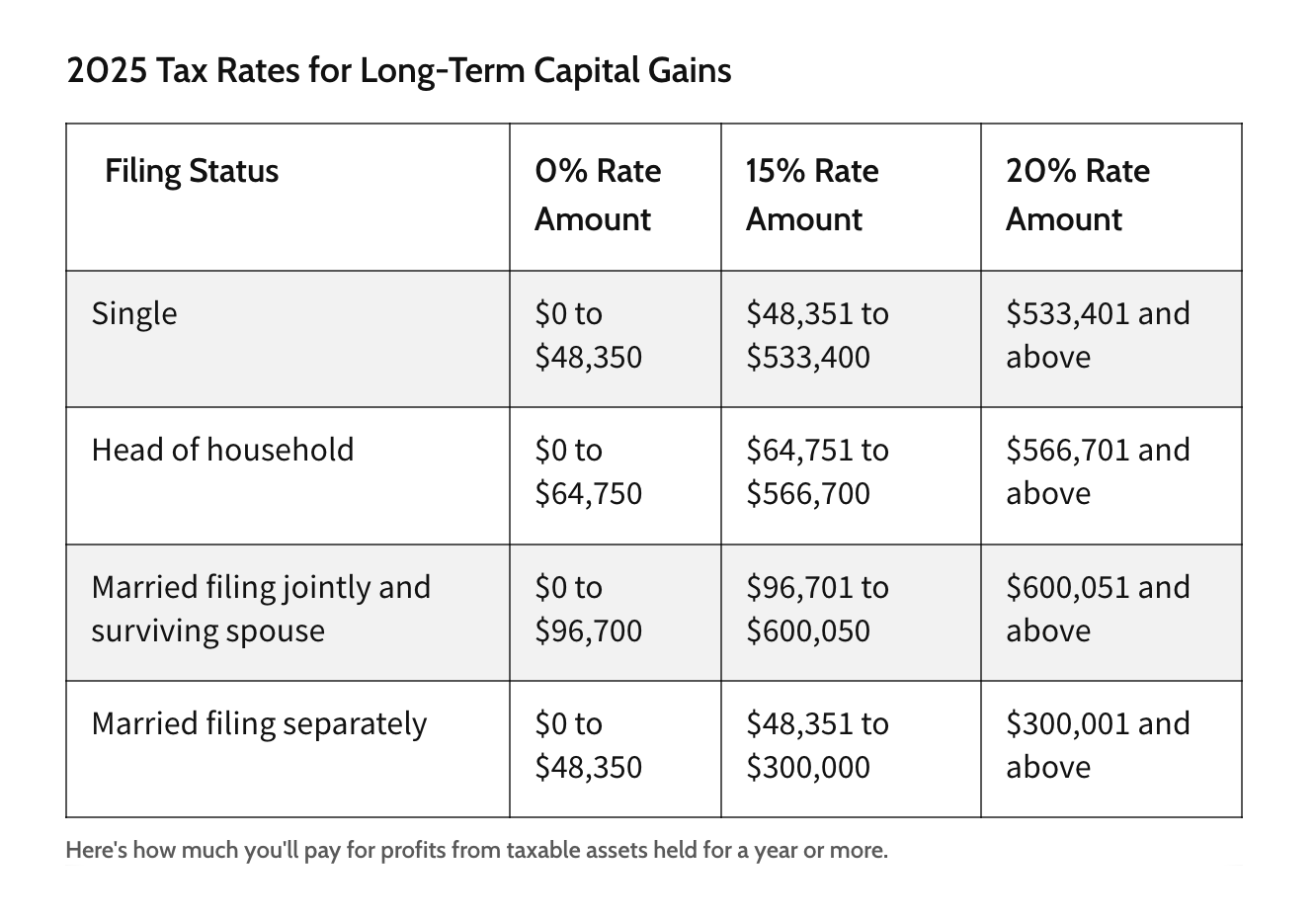

The Significance of Capital Gains Taxes

Capital gains tax is a levy on the profit you make from selling a capital asset, such as a stock, bond, or piece of property.

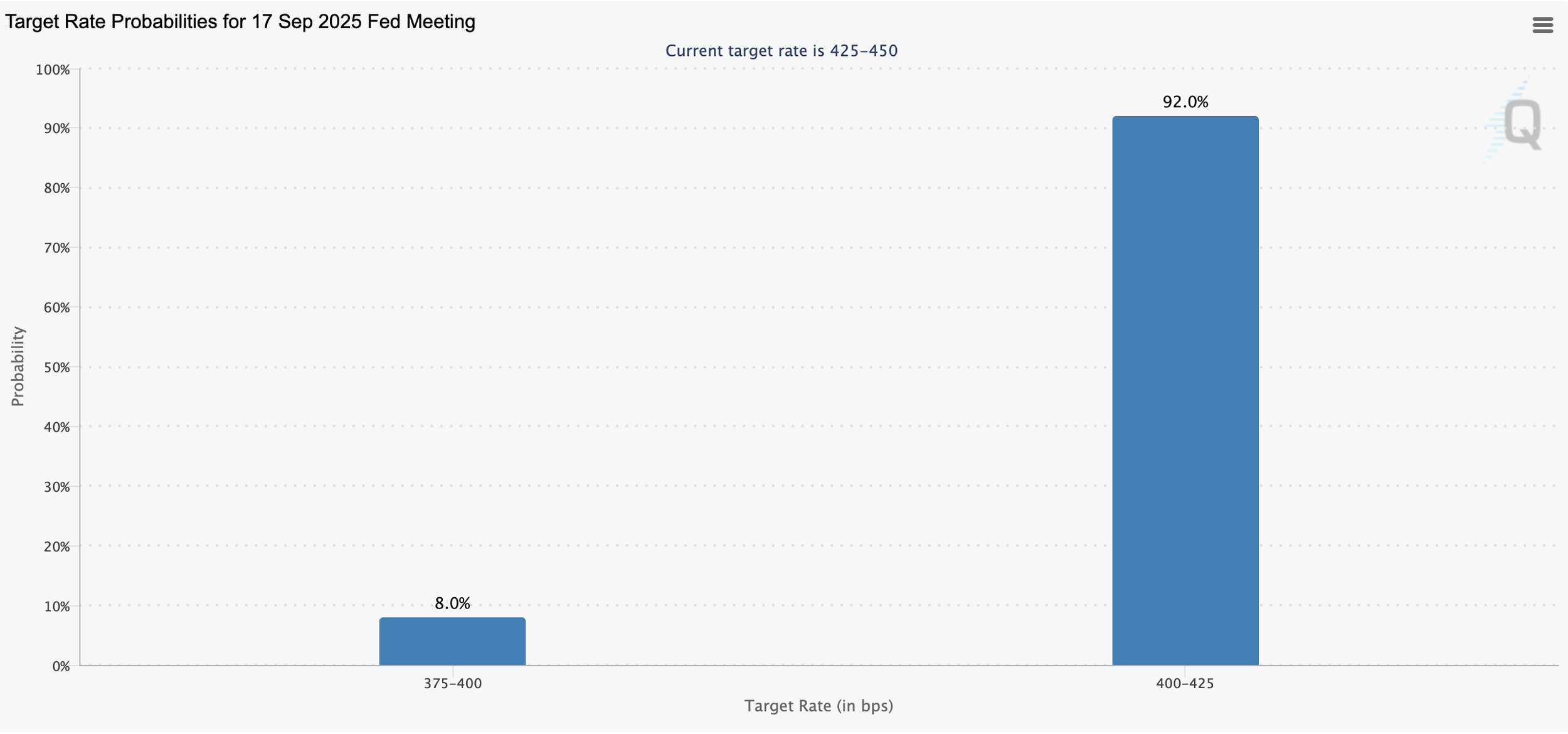

Job Losses Opens Door to Rate Cuts

The morning of Aug. 22, Fed chair Jerome Powell gave a speech at the annual Jackson Hole economic symposium signaling a possible September cut to interest rates.

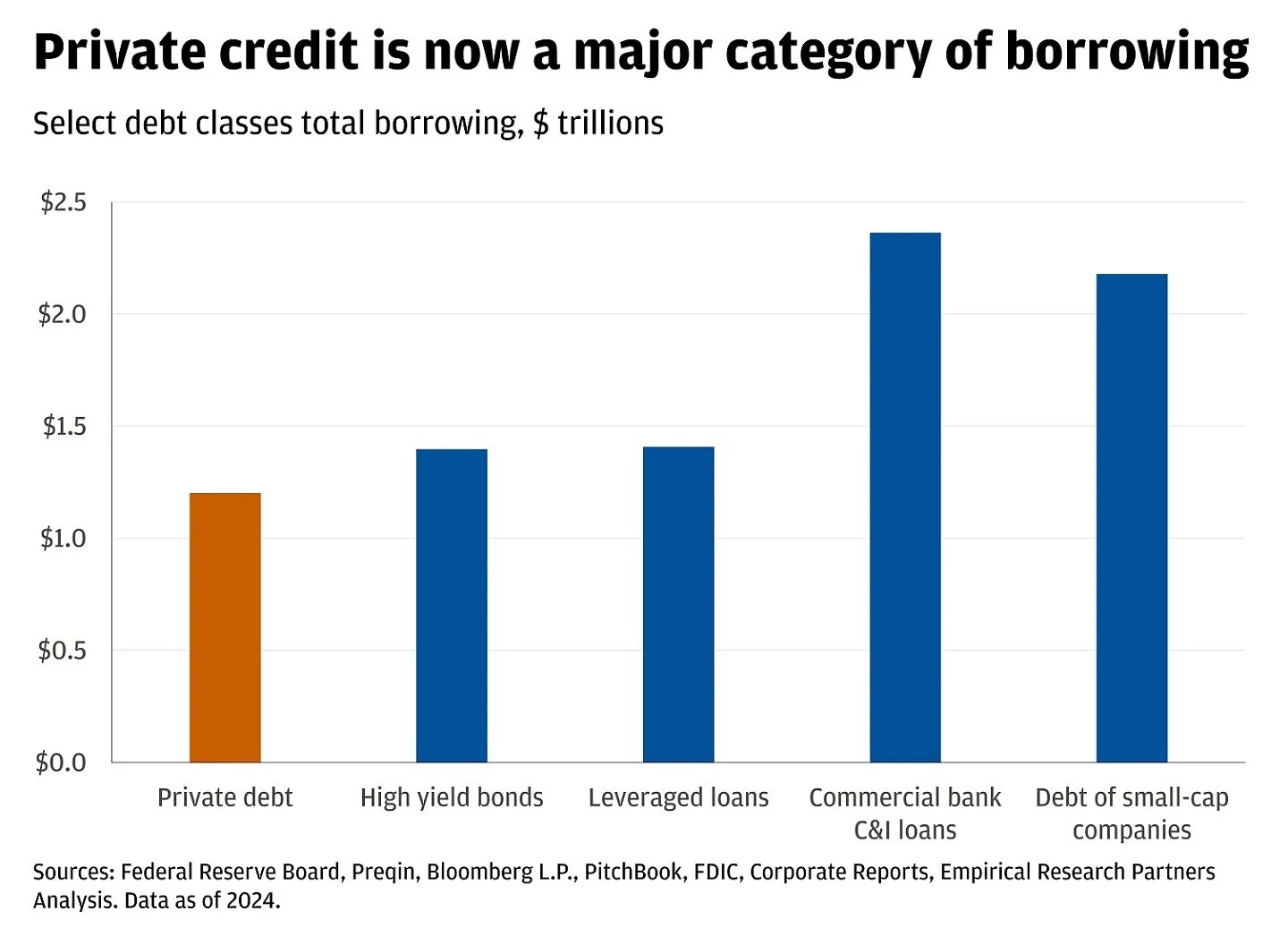

Understanding Private Credit’s Attraction

The United States is centerfold in the credit portfolios catalog. Oaktree Capital, an asset management company, cited that the country has “the most accommodative capital markets in the world.”

A Closer Look: The Growth of Behavioral Finance

Behavioral finance, as reviewed in our July newsletter, is “an economic theory that ascribes the irrational behavior of individuals making financial choices to psychological factors or biases,” according to Investopedia.

Treasury Secretary Bessent Discusses U.S. Investment Climate and Tax Policy on CNBC

On a recent CNBC appearance, Treasury Secretary Scott Bessent commented on the current U.S. investment environment, signaling administrative interest in promoting long-term economic growth.

What is the Breadth Thrust Indicator?

The Breadth Thrust Indicator is an indicator used to determine the momentum and direction of the market.

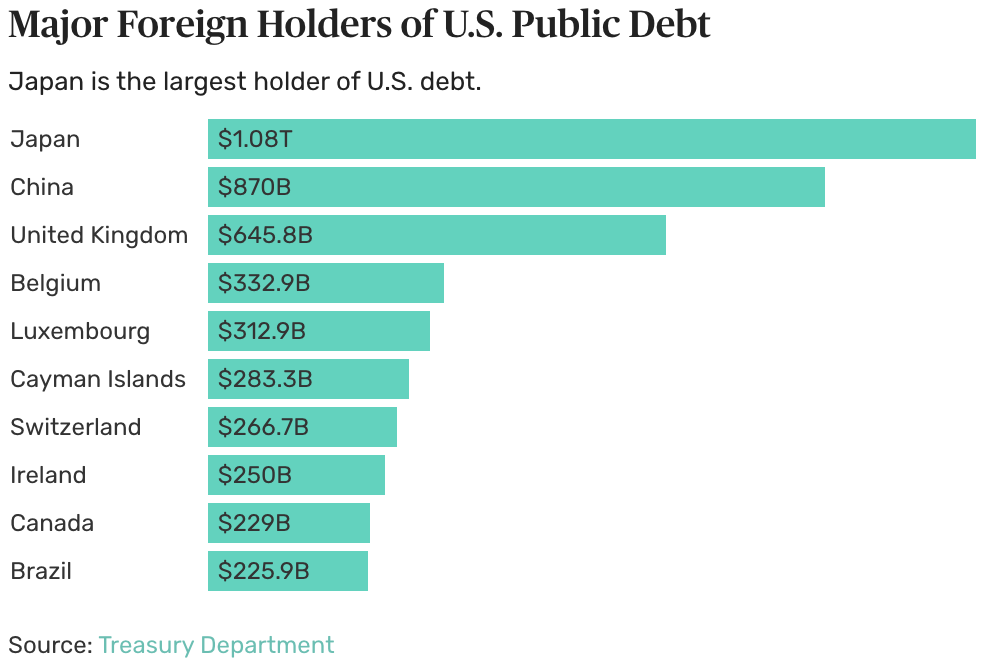

The Importance of the US Treasury 10-year Interest Rate

The US 10-year Treasury rate is an important reference point of market expectations for future inflation and US long-term interest rates.

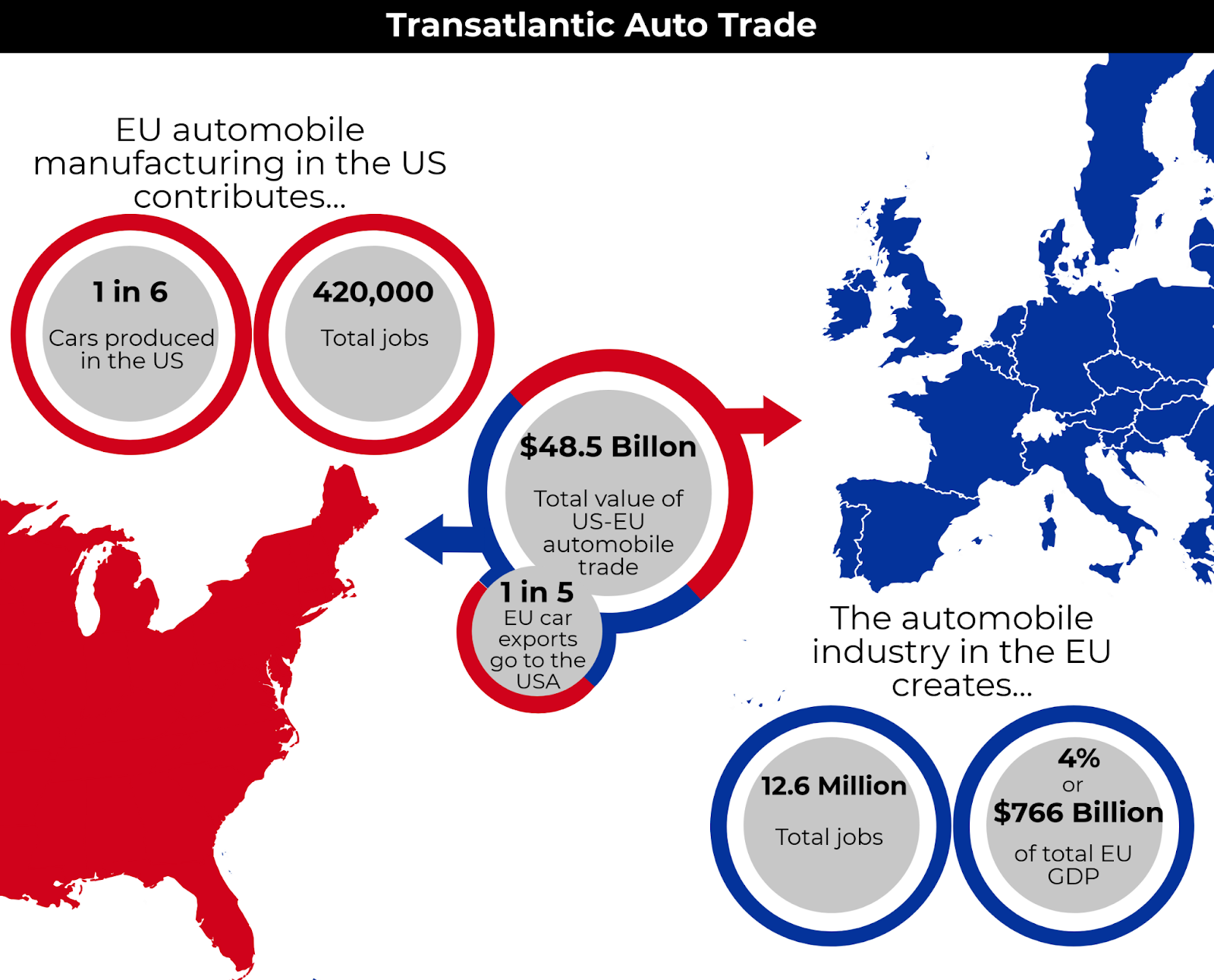

Recent Auto Tariffs

On Wednesday, President Trump announced a 25% import tax on all foreign-made cars to become permanently effective April 2nd.

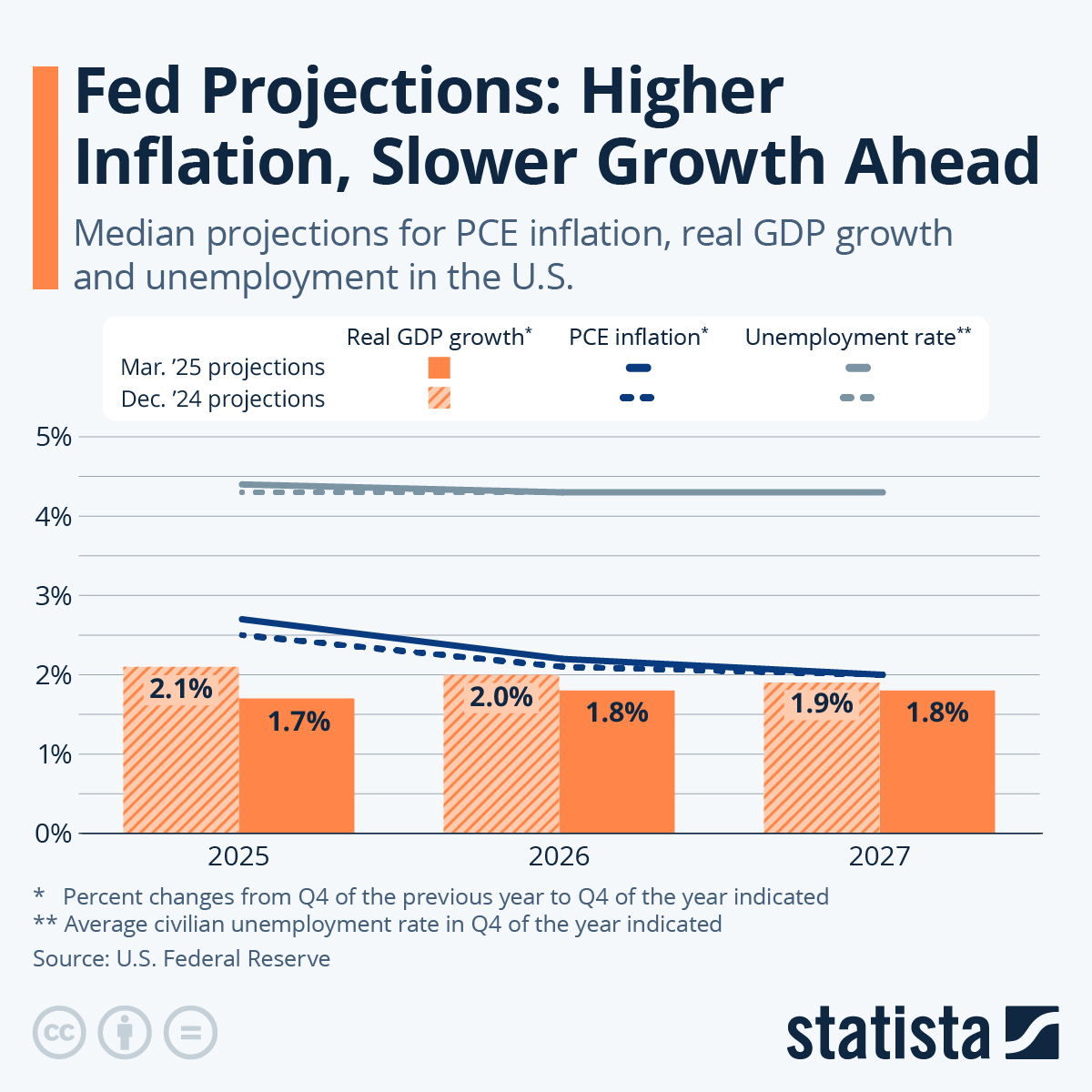

FOMC Findings

Following the meeting of the Fed’s Open Market Committee, investors were anxiously waiting to hear their decisions regarding interest rates and the current trajectory of the US economy.

Consumers’ Worst Fears for 2025

Consumers continue to feel uncertain about current economic conditions while worries still remain regarding our political environment.

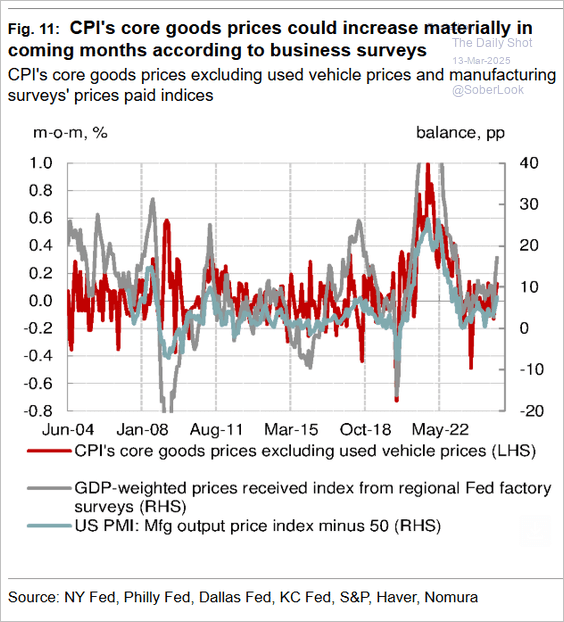

Impact of Recent Tariffs on US Economy

President Trump has announced a range of tariffs on major trade partners like China, Mexico, and Canada. China has responded with their own tariffs on imports from the US. These tariffs will negatively impact every economy involved.

Read the Great Point Capital Newsletter.

Your source for navigating the world of Alternative Investments.